1031 Exchange Guide for Investment Property in Southern New England: How to Defer Capital Gains Taxes

Spectrum Real Estate Consultants

Spectrum Real Estate Consultants Team is the top producing team of Realtors at Keller Williams Realty Leading Edge completing over 1,000 successful tr...

Spectrum Real Estate Consultants Team is the top producing team of Realtors at Keller Williams Realty Leading Edge completing over 1,000 successful tr...

If you're exploring investment property in Rhode Island, Massachusetts, or Connecticut, you've likely heard about 1031 exchanges—a powerful tax strategy that allows real estate investors to defer capital gains taxes when selling one property and purchasing another. But understanding how 1031 exchanges actually work, when they make sense, and how to execute them properly can feel overwhelming, especially for first-time investors.

That's where working with experienced real estate agents who understand investment strategies across Southern New England makes all the difference. At Spectrum Real Estate Consultants, we guide investors through the entire process—from identifying the right properties to coordinating with qualified intermediaries and tax professionals to ensure your exchange stays on track.

Here's everything you need to know about 1031 exchanges and how they can help you build wealth through real estate investment across Rhode Island, Massachusetts, and Connecticut.

What Is a 1031 Exchange and Why Does It Matter?

A 1031 exchange—named after Section 1031 of the Internal Revenue Code—allows you to sell an investment property and reinvest the proceeds into another "like-kind" property while deferring all capital gains taxes. Instead of paying taxes on your profit when you sell, you can roll that money into your next investment and continue building wealth.

Why Real Estate Investors Use 1031 Exchanges

While deferring capital gains taxes is the most well-known benefit, sophisticated investors use 1031 exchanges to achieve multiple strategic goals beyond tax savings:

Portfolio Upgrading ("Trade Up")

Use the exchange to move from a smaller or older asset into a larger property, a better location, or a property with stronger tenant quality and longer-term leases.

Consolidation or Diversification

Exchange multiple properties into one larger asset to simplify management, or exchange one property into multiple replacements to spread risk across markets, property types, or tenants.

Improving Cash Flow

Shift from a low-yield property into one with higher net operating income, better rent growth, more potential upside regarding increase in future property value, or stronger expense recovery structures typically seen in commercial properties (e.g., moving from gross leases to NNN where appropriate).

Reducing Management Burden

Many investors exchange out of high-maintenance properties (older multifamily, heavy CapEx) into more "hands-off" holdings—often newer construction, professionally managed assets, or properties with fewer operational headaches.

Repositioning Risk

Move out of a property with a looming roof/parking lot/structural project, weak tenant mix, high vacancy risk, or a market showing slowing demand—and into an asset with a clearer long-term thesis.

How Much Could You Save With a 1031 Exchange?

Here's why this matters: when you sell an investment property without doing a 1031 exchange, the profit is often hit by multiple layers of tax.

The Tax Layers You're Facing

Federal Taxes:

▪️ Long-term capital gains: Up to 20%

▪️ Net Investment Income Tax (NIIT): 3.8% for higher-income taxpayers

▪️ Depreciation recapture (unrecaptured Section 1250 gain): Up to 25% on the depreciation portion (this is why real estate sales can feel "more expensive" than stock sales)

State Taxes (Ordinary Income Rates):

▪️ Rhode Island: 3.75%–5.99%

▪️ Massachusetts: 5% (and it may effectively be higher for income over the surtax threshold)

▪️ Connecticut: 2%–6.99%

Total Impact:

A realistic rule of thumb for many sellers in RI/MA/CT is an all-in total tax impact of roughly ~25%–40% of the gain, depending on income level, depreciation taken, and where you file.

That's why a properly executed 1031 exchange can be so powerful: it can defer these income taxes so more of your equity stays invested in the next property.

Example: Selling an Investment Property with $200,000 in Gains

❌ Without a 1031 Exchange

Estimated Total Taxes (Typical Range for RI/MA/CT):

$50,000–$80,000

(~25%–40% of gain)

Why it varies: NIIT may or may not apply, state rate depends on where you file, and depreciation recapture can push the federal portion higher.

Illustrative Example (One Common Scenario):

If someone is in the top federal long-term capital gains bracket (20%), NIIT applies (3.8%), and their state rate is about 5%, then:

▪️ 20% federal LTCG = $40,000

▪️ 3.8% NIIT = $7,600

▪️ ~5% state tax = $10,000

Illustrative total: $57,600

Note: This example is simplified; if a meaningful portion of the $200,000 gain is tied to depreciation, the federal total could be higher because that portion can be taxed up to 25%.

✓ With a Properly Executed 1031 Exchange

Estimated Income Taxes Paid Today:

$0

(tax deferred)

Estimated Tax Deferred:

$50,000–$80,000

💰 That's potentially $50,000–$80,000

you can reinvest instead of paying out in taxes right now

The beauty of this strategy? You can continue exchanging properties throughout your investment career, deferring taxes each time and building a larger portfolio. Many investors use 1031 exchanges to trade up from smaller multi-family homes into larger apartment buildings, or from single properties into multiple rental units across Providence, Worcester, Hartford, and throughout Southern New England.

How 1031 Exchanges Work: The Critical Timeline

The mechanics of a 1031 exchange are straightforward, but the timeline is absolutely unforgiving. Miss a deadline by even one day, and the entire exchange fails—meaning you'll owe all the taxes you were trying to defer.

Here's how the process works:

Step 1: Hire a Qualified Intermediary Before You Sell

Before you close on the sale of your property (called the "relinquished property"), you must hire a Qualified Intermediary (QI). This is a neutral third party who will hold your sale proceeds in a segregated account. You can never touch the money yourself—if you do, the exchange is disqualified and you'll owe taxes immediately.

The QI handles all the paperwork, holds the funds, and ensures compliance with IRS regulations. Several qualified intermediaries serve Rhode Island, Massachusetts, and Connecticut, and our team at Spectrum Real Estate Consultants works with the most reputable ones across Southern New England to ensure smooth transactions for our clients.

Step 2: Identify Replacement Properties Within 45 Days

From the day your relinquished property closes, you have exactly 45 calendar days to identify potential replacement properties in writing. This identification must be specific (full street addresses), signed, and delivered to your Qualified Intermediary before midnight on day 45. No exceptions. No extensions.

The most common approach is the "three-property rule"—you can identify up to three properties regardless of their total value. This gives you flexibility to pursue multiple options while negotiations and due diligence are ongoing. If you're looking at commercial real estate or multiple rental properties, you might identify a mix of options across different markets to increase your chances of closing successfully.

This is where having a knowledgeable real estate agent becomes critical. Across Southern New England, tight inventory conditions make finding suitable replacement properties within 45 days challenging. We help our investor clients get ahead of the market before they even list their relinquished property.

Step 3: Close on Replacement Property Within 180 Days

You have 180 calendar days from the sale of your relinquished property to close on your replacement property (or by your tax return due date, whichever comes first). This sounds like a lot of time, but remember—after the 45-day identification period ends, you only have 135 days left to close.

What Happens If Your 1031 Exchange Fails?

If an exchanger doesn't properly identify replacement property within 45 days or doesn't acquire replacement property within 180 days, the exchange generally fails and the disposition is treated as a taxable sale (subject to any partial deferral rules if they did acquire something but not enough).

In the most common outcome—no replacement property acquired—the gain is typically recognized for federal income tax in the tax year the relinquished property was transferred/sold, and the tax is normally paid when the return for that year is filed (including extensions), though large gains may require estimated tax payments during the year to avoid underpayment penalties.

Year-end timing consideration: If the sale occurs late in the year and the exchange fails after year-end, the sale is still generally a sale in the prior year, but the exchange proceeds may be held by the qualified intermediary until the exchange period ends under the IRS "safe harbor" rules that limit the taxpayer's access to funds. Depending on the exact facts (and whether funds are released in a later year), some taxpayers may need CPA guidance on whether installment-sale reporting concepts apply to the timing of when cash is treated as received for tax purposes in a cross-tax-year "failed exchange" scenario.

Requirements for Full Tax Deferral

To achieve full tax deferral in a 1031 exchange, you generally need to meet two core tests (plus a common third consideration):

1. Equal or Greater Value

Acquire replacement real estate with a total purchase price (fair market value) that is equal to or greater than the value of the property you sold. As a practical matter, many exchangers aim for a replacement purchase price at least as high as the relinquished property's contract sales price, but certain closing costs on the sale can reduce the amount treated as your "exchange value" for these purposes.

Important: Selling expenses (like brokerage commissions and certain closing costs) can reduce the amount of proceeds/value you're treated as exchanging, which means "equal or greater" may be satisfied even if the replacement purchase price is slightly below the gross sale price in some fact patterns.

2. Reinvest All Proceeds

Reinvest all net exchange proceeds into the replacement property(ies). If you receive cash back at closing (or have exchange funds used for non-exchange items), that amount is generally taxable "boot."

3. Replace Any Debt (Mortgage Boot Consideration)

If you paid off a mortgage (or other debt) on the property you sold, you typically need to replace that debt on the purchase (or add equivalent cash) to avoid debt relief ("mortgage boot").

Simple rule: Your replacement property(ies) should generally be equal or greater in total value, and you must reinvest all net exchange proceeds (and replace any debt paid off) to avoid taxable boot.

Source: IRS Form 8824 Instructions; Treas. Reg. 1.1031(k)-1

Do closing expenses matter? Yes. Not all costs count the same way. Some items paid from exchange funds can create boot (especially certain loan-related charges and prorations), so the "reinvest all proceeds" rule is the one where closing statement details matter most.

For example: if you sell a duplex for $400,000 with $300,000 in net proceeds, your replacement property must be worth at least $400,000 and you must reinvest the full $300,000. If you only reinvest $250,000, you'll pay capital gains tax on the $50,000 difference.

Critical 1031 Exchange Timeline

Property Sells

QI holds proceeds

Deadline

Identify properties

Final Deadline

Close on replacement

⚠️ These deadlines are absolute—no extensions available

What Qualifies as "Like-Kind" Property?

The good news: "like-kind" is extremely broad when it comes to real estate. As long as both properties are investment or business real estate held in the United States, they qualify. This means you can exchange:

• A single-family rental home for a multi-family property

• An apartment building for commercial retail space

• Vacant land for a warehouse

• Industrial property for office buildings

• Property in Rhode Island for property in Massachusetts or Connecticut

What doesn't qualify: your primary residence, vacation homes you personally use, properties held primarily for resale (like fix-and-flip projects), and real estate outside the United States. The property must be held for investment or business purposes—not personal use.

What Is a Reverse 1031 Exchange?

In a standard 1031 exchange, you sell first and then buy. But what happens when you find the perfect replacement property before you've sold your current one? That's where a reverse 1031 exchange comes in.

A reverse exchange allows you to acquire your replacement property first, then sell your relinquished property within 180 days. This solves a major timing problem—especially in competitive markets across Southern New England where ideal investment properties don't stay on the market long.

Here's how it works: since you can't hold title to both properties simultaneously under IRS rules, an Exchange Accommodation Titleholder (EAT)—typically your Qualified Intermediary or a subsidiary—temporarily holds title to one of the properties. The EAT usually forms a single-member LLC to "park" the property, then leases it back to you while holding legal title. You then have 180 days to complete the exchange.

The Trade-Offs: Higher Costs and Financing Challenges

Reverse exchanges solve timing problems but come with significantly higher costs. While standard forward exchanges typically cost $750 to $1,500 in Qualified Intermediary fees, reverse exchanges commonly run $3,000 to $10,000 plus additional legal fees of $1,500 to $3,000 for loan document review and LLC formation.

The bigger challenge? Financing. You need funds to purchase the replacement property before receiving proceeds from your sale. Most conventional lenders won't finance properties held in an EAT's name, and reverse exchange loans can't be sold on the secondary market. This typically means working with portfolio lenders (smaller banks that keep loans on their books), bridge loans, hard money financing, or making all-cash purchases.

Despite these challenges, reverse exchanges make strategic sense when you've found an exceptional replacement property in a tight market. Across Rhode Island, Massachusetts, and Connecticut—where quality investment properties move quickly—securing the replacement first can be worth the extra cost.

Forward vs. Reverse 1031 Exchange Comparison

| Feature | Forward Exchange | Reverse Exchange |

|---|---|---|

| Order of Events | Sell first, then buy | Buy first, then sell |

| Typical Cost | $750 - $1,500 | $3,000 - $10,000+ |

| Financing Complexity | Straightforward | Difficult (EAT issues) |

| Best For | Standard situations | Found perfect property first |

| Timeline Pressure | High (45-day search) | Lower (property secured) |

State-Specific Considerations for 1031 Exchanges in RI, MA, and CT

Rhode Island, Massachusetts, and Connecticut generally follow the federal 1031 exchange rules, so the core exchange requirements and deadlines are the same. Where investors get surprised is usually not the exchange itself, but the state-level "transaction mechanics" that can still apply at closing and later on.

General Expectations in This Region

1. Transfer Taxes Still Apply

Real estate transfer taxes / conveyance "tax stamps" are still due when deeds are recorded—because those are recording/transfer taxes, not capital gains taxes. A 1031 exchange defers income tax, but it doesn't override state transfer taxes.

2. Nonresident Withholding Requirements

If you're selling as a nonresident of the state where the property is located, there may be a withholding requirement at closing unless the proper exemption or certification is handled in advance. This is typically a withholding/collection mechanism, not automatically your final tax bill.

3. Multi-State Filing Considerations

If you exchange out of one state and buy in another, you may have long-term state filing considerations—especially around tracking deferred gain—so it's smart to keep good records and confirm the strategy with a CPA familiar with multi-state real estate transactions.

Bottom line: A 1031 exchange defers federal and state income taxes on capital gains, but it doesn't override state transfer taxes or state withholding rules at closing.

Rhode Island Specifics

Rhode Island provides a straightforward environment with complete conformity to federal rules. However, non-resident sellers must address Rhode Island's 6% mandatory withholding on the total sale price (9% for corporations) unless you submit Form 71.3 at least 20 days before closing to claim the 1031 exchange exemption. This isn't a tax you owe—it's a withholding requirement. The key is proactive planning: work with your Qualified Intermediary and real estate team to file the exemption form well before closing.

Massachusetts Specifics

Massachusetts has a unique "clawback provision." When you sell property in Massachusetts and exchange it for replacement property in Rhode Island, Connecticut, or another state, Massachusetts reserves the right to collect state capital gains tax when you eventually sell that replacement property in a taxable transaction—even years later and regardless of where the sale occurs. This doesn't prevent the exchange, but it's an important long-term tax planning consideration.

Connecticut Specifics

Connecticut generally conforms to federal 1031 exchange rules. However, Connecticut requires withholding of 6.99% of the sales price from non-residents unless an exemption is filed. Connecticut also has a conveyance tax on real estate transfers that applies even in 1031 exchanges, though the exchange itself defers capital gains taxes.

Finding the Right Replacement Property Across Southern New England

Southern New England's real estate markets present unique challenges for 1031 investors. Tight inventory conditions across Rhode Island, Massachusetts, and Connecticut make finding suitable replacement properties within the 45-day identification window challenging—but not impossible with strategic planning.

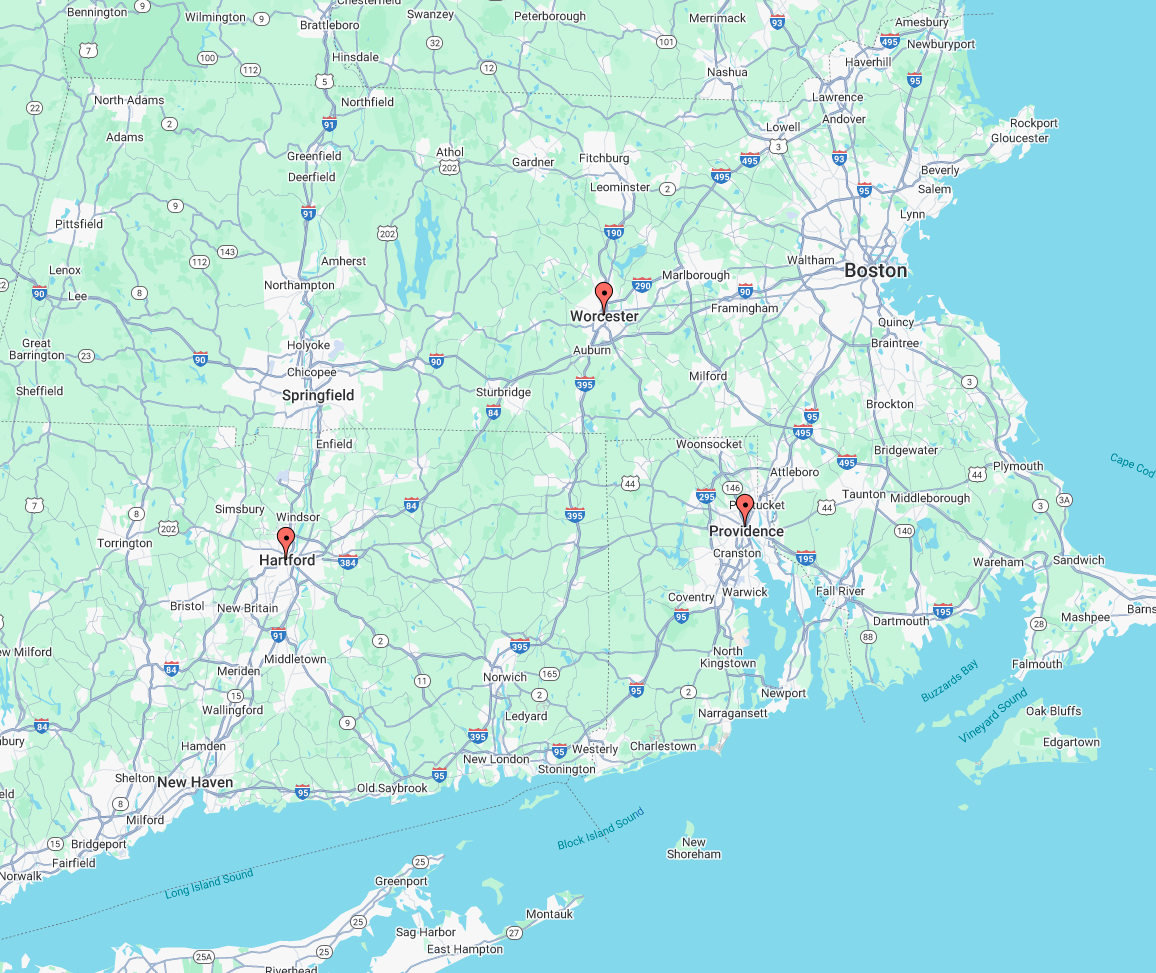

Southern New England Investment Property Hotspots

Top investment property markets for 1031 exchanges across Rhode Island, Massachusetts, and Connecticut

🏛️ Providence, RI

17.5% YoY growth • University markets • 60% renters under 35

🏭 Worcester, MA

Strong growth • Biotech hub • Multi-family opportunity

🏙️ Hartford County, CT

Insurance sector • Commercial assets • Steady appreciation

The strongest opportunities for investment property across the region include:

Providence & Northern Rhode Island: The strongest growth market in Rhode Island at 17.5% year-over-year, driven by Brown University and RISD, healthcare sector expansion, and rental demand. Towns like Cumberland, Smithfield, and North Smithfield offer more affordable entry points while maintaining excellent tenant demand.

Worcester & Central Massachusetts: Massachusetts' second-largest city offers strong multi-family opportunities with growing biotech and healthcare sectors. More affordable than Greater Boston while maintaining solid appreciation and rental demand.

Hartford County, Connecticut: Insurance and financial services hub with stable commercial property demand. Towns like Glastonbury, Simsbury, and West Hartford provide strong suburban rental markets.

Industrial Assets: The Quonset Business Park in Rhode Island ranks among the top ten industrial parks nationally. Similar opportunities exist in Connecticut's I-84 corridor and Massachusetts' Route 495 belt.

Multi-Family Properties: From duplexes to larger apartment buildings, multi-family housing continues to offer strong cash flow and appreciation potential throughout Southern New England.

1031 Exchange Opportunities Across Southern New England

Our team at Spectrum Real Estate Consultants specializes in helping investors navigate tight market conditions across Rhode Island, Massachusetts, and Connecticut. We monitor new listings daily, maintain relationships with property owners considering sales, and can often connect investors with off-market opportunities that never hit public listings. This proactive approach is essential when you're working within the unforgiving 45-day identification timeline.

⚠️ Common 1031 Exchange Mistakes to Avoid

- Forgetting to hire QI before closing – You must engage before your relinquished property closes

- Missing the 45-day identification deadline – Even by one day disqualifies the entire exchange

- Touching the proceeds – Any constructive receipt voids the exchange

- Not reinvesting all proceeds – Creates taxable "boot" on the difference

- Using a disqualified person as QI – Your agent from the last 2 years can't serve as QI

Why Working with Experienced Real Estate Professionals Matters

1031 exchanges are powerful wealth-building tools, but they're also technically complex with zero margin for error. Miss a deadline, fail to properly identify properties, or inadvertently take constructive receipt of funds, and the entire exchange fails—leaving you with a substantial tax bill.

That's why having the right team matters. At Spectrum Real Estate Consultants, we bring specialized expertise in investment property transactions across Rhode Island, Massachusetts, and Connecticut. Our role is to:

• Help you identify potential replacement properties before you even list your current property

• Connect you with qualified intermediaries and tax professionals who specialize in exchanges

• Track critical deadlines and keep your exchange on schedule

• Provide immediate access to new listings and off-market opportunities across all three states

• Navigate state-specific withholding requirements in Rhode Island, Massachusetts, and Connecticut

• Coordinate with all parties to ensure smooth closings on both sides of the exchange

We can educate you on exchange benefits and help you navigate the process, but we always refer you to qualified tax and legal professionals for specific advice about your situation. That's because while we understand how exchanges work, only your CPA or tax attorney can determine whether an exchange makes sense for your particular financial circumstances.

Ready to Explore 1031 Exchange Opportunities?

Whether you're considering your first 1031 exchange or looking to expand your existing investment property portfolio, the key is starting with the right information and the right team.

At Spectrum Real Estate Consultants, we've helped investors across Rhode Island, Massachusetts, and Connecticut successfully navigate exchanges—from standard forward exchanges to complex reverse transactions. We understand the tight timelines, the market challenges, and the strategies that work in Southern New England's competitive environment.

If you're thinking about selling an investment property or looking to acquire your next investment, let's talk. We'll walk you through your options, connect you with the right professionals, and help you develop a strategy that maximizes your wealth-building potential while minimizing your tax burden.

Because when it comes to building long-term wealth through real estate, keeping more of your gains working for you—instead of paying them to the IRS—makes all the difference.

Buy investment property in RI | Sell investment property in RI | Commercial real estate | Read more blogs